Bookkeeping

How To Manage and Record Cash Receipts

Subsequently on a regular (usually daily) basis, the line items in the cash journal are used to update the subsidiary ledgers. Generally most cash receipts are from credit sale customers, and the subsidiary ledger updated is the accounts receivable ledger. As can be seen in the above example, 550 is posted to the ledger account of customer A and 350 to customer C. When posting to the accounts receivable ledger, a reference to the relevant page of the receipts journal would be included. Additionally, cash receipt journals can also help with cash payments that may be on an accrual basis while providing detailed lists of all the cash the company receives. Many businesses enjoy the benefits of a cash receipts journal as depending on the business, a large portion of their customers may prefer to use cash.

Do you own a business?

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- All additional cash sources, including bank interest, investment maturities, sales of non-inventory assets, sales of fixed assets, etc.

- In this case the debit entry to the cash account represents the cash collected from customers for the period, which increases the asset of cash.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- If you lose one or more cash sales receipts, it may be difficult to have an accurate balance sheet because the cash account will be incorrect.

- When customers pay with a mixture of payment methods, you need to account for it.

The beneficiary of an escrow agreement should be waryif an escrow agent delays in releasing escrow property. And a bounced checkfrom an escrow agent is a signal that escrow money might have been misused.In these situations, the careful consumer will promptly 13 things bookkeepers do for small businesses consult a lawyer. Cash receipt journals are not for transactions such as credit sales and debit but are meant for cash payments only. For additional accounting such as debit and credit sales transactions, it is best to find other sources for management.

Time Value of Money

A cash receipts journal is also known as a specialised accounting journal. In cash receipt remitties journals, cash receipt records are recorded in the CRJ. A cash payment journal consists of the records of every amount paid by a customer. A miscellaneous cash receipt is for cash not received in the ordinary course of daily business. Examples would be the proceeds for loan payments, money for increased capital investment, and refunds from vendors. Additionally, accessing monetary information through a cash receipts journal is far quicker than tracking the cash payment through a ledger.

Bookkeeping

You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day. At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records.

Related AccountingTools Courses

Recording cash receipts offsets the accounts receivable balance from the sale. Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal. When a retailer sells merchandise to a customer and it collects cash, this transaction is recorded in the cash receipts journal.

Credit sales are transactions where the goods are sold and payment is received at a later date. The source documents for the Sales journal are copies of all invoices given to the debtors. A column for the transaction date, account name or customer name, invoice number, posting check box, accounts receivable amount, and cost of goods sold amount. Since all sales recorded in the sales journal are paid on credit, there is no need for a cash column. This entry records the amount of money the customer owes the company as well as the revenue from the sale.

Similarly, it also provides an easy way to keep track of all the unpaid supplier and vendor payments by allowing the business to quickly see what cash was received and paid out during a said period. In this case the debit entry to the cash account represents the cash collected from customers for the period, which increases the asset of cash. In addition, lawyers whohelp clients seek reimbursement cannot charge legal fees for thisprofessional service. You must be able to substantiate certain elements of expenses to deduct them on your tax return.

After making credit sales to the consumer based on the advanced credit period, any money is subsequently collected. The New York Lawyers’ Fund is a state agency that the legal professionfinances to protect law clients from dishonest conduct in the practice oflaw. A common example involves the down payment in the purchase and sale of aresidence, condominium or cooperative.

Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting. Depending on how frequently you get cash from customers, there can be a lot of entries in this journal. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

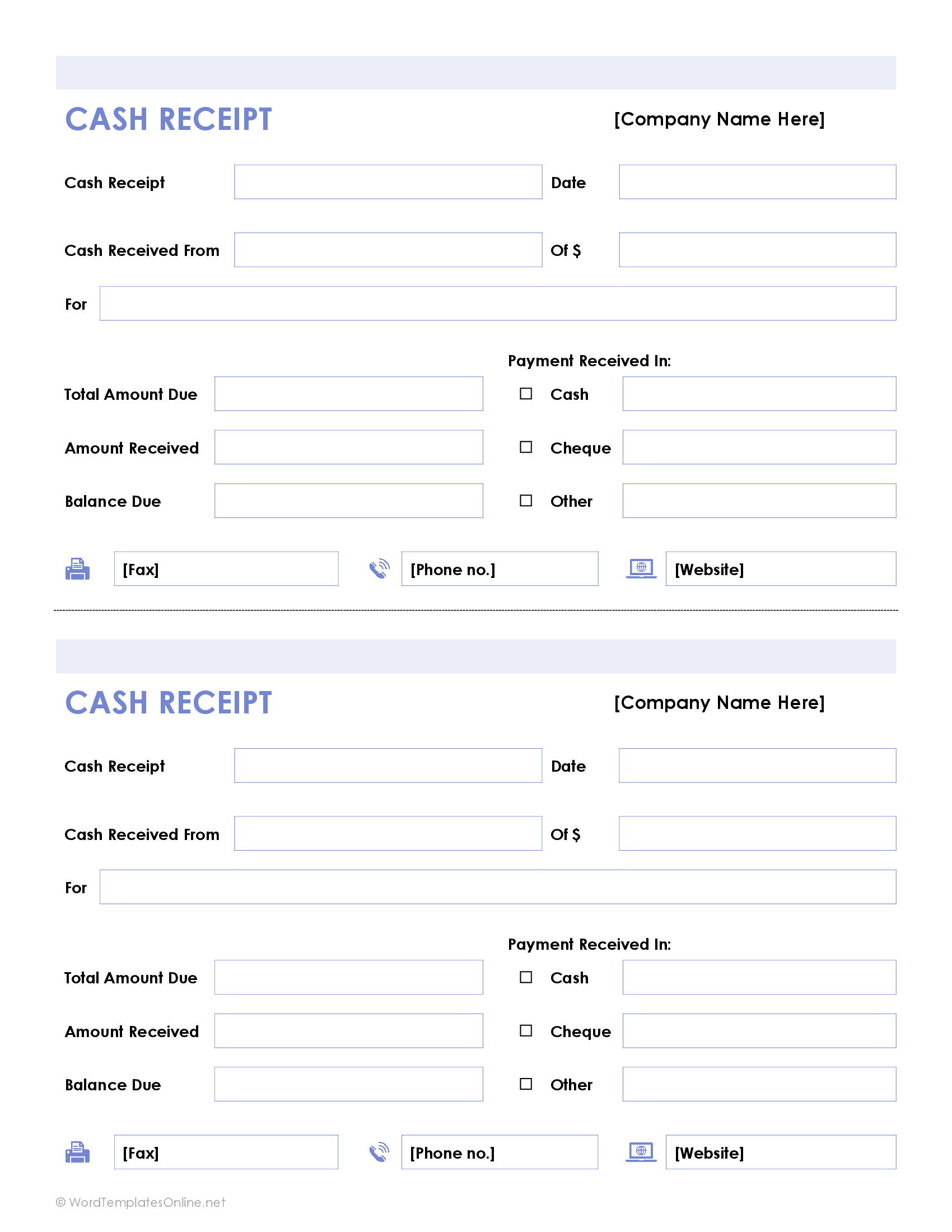

A general journal is used to record unique journal entries that cannot be processed in a more efficient manner. For example, checks written, sales invoices issued, purchase invoices received, and others can be recorded in a computerized accounting system when the documents are processed. Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal. The cash receipts diary also contains information on any additional loans that a person has taken out from banks or other financial institutions. Tax refunds for direct and indirect taxes, any fee or commission collected, or the maturity of an investment or insurance policy.